Electronic Money as an Alternative to Paper Money

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 1017 words | ✅ Published: 29 Aug 2017 |

Electronic money (smart card), The Alternative Way of Paper Money

Abstract:

Everyday life has suburbanized by the modern technologies and money is not exclusion. The conventional ways of the monetary exchange has improved into electronic ones. Tonight electronic money has become progressively fashionable among people and around the globe.

But some implementation of e-money e.g. credit card is not so efficient because it requires an extra machine to read the card. If we can make a system embedded which will not require a machine to read. . Inside the system there will be a microprocessor and other necessary mechanism to transaction. To provide security we will propose a biometric mechanism.

Introduction:

Electronic money, or e-money, is the money balance recorded electronically on a stored-value card. Progressively, People are using computer networks and spend for goods and services with electronic money. In 1983, a research paper by David Chaum introduced the idea of digital cash [4]. Every day we face the retail money problem. In an electronic payment system a user can reduce the problem of the retail money. Every user must bear a small weightless card which will be made with his/her NID. When need to purchase something, just give the finger print and the enter the amount to transact. For the security purpose user can track the card using the mobile phone. For renewing the smart card user need to submit NID and then will get a new one according to the old serial number. By implementing the new system, we need some time to cope with the people. We need to show them the importance of smart card. We may need to provide some training to use the system. Once the people came to the agreement of using the system they will highly beneficial.

Today we live in an era where various technologies are used to serve the mankind. In 1997, Aleksander Berentsen from university of Bern analyzed about monetary policy implications of digital money. He talked about the bespeak of the electronic money, its diagnostic procedure and monetary control mechanism. According to the paper, electronic money generally two types. First one is network money and second one is smart card. Also says that the implementation of the electronic money can hydrolyze the central bank [1].

In Bangladesh there are some implementations of e-money which are:

- Bkash

Bangladesh’s initial accomplished mobile financial service provider, bKash Limited, a BRAC Bank supplementary, started its mobile banking activities in July 2011[6]. BKash was fashioned to yield fiscal services via mobile phones to the mankind of Bangladesh.

- National Payment Switch

A public wharf for the commercial banks for e-payments, National Payment Switch established by Bangladesh Bank which is acting to set up E-commerce in Bangladesh.

After joining all banks to the NPS (National Payment Service), customer can collect cash from any ATM and POS (point of sales) by using a credit or debit card.

- Internet Banking or Online Banking

Online banking (or Internet banking or E-banking) permits consumer of a fiscal organization to deal financial dealings on a procure website handled by the institution. To access the organizational website, customer’s have a username and password. Username and password must not be same.

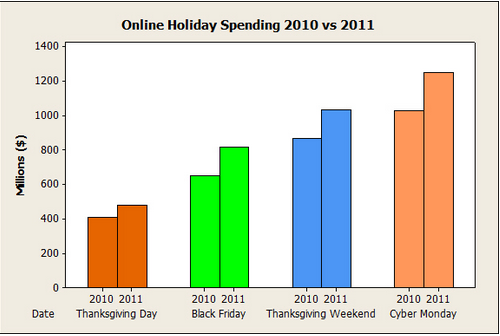

Day by day the uses of e-money is becoming beneficial, showing a bar chart regarding its uses:

Fig. 1. Online Holiday Spending [7]

Some countries like Hong Kong (octopus card), Netherland (chipknip), and Belgium (proton) have a kind of electronic money system.

Hong Kong’s octopus card requires a machine to read [8]. Belgium’s proton has a limitation. For security, the card is limited to storing 125.00 EUR and for small payment it didn’t need any code or signature so there is a chance of losing money.

Proposed Research Methodology:

People already have started getting the benefit by using e-money. In our country it is used by a specific category of people. In this research we will try to make our system so efficient that it is widely used by all categories of people. In our country, to use e-money system, we need a machine to read the card. But our system should be an embedded system. So it will not need an extra machine to read. The whole things will hold a single card. Inside the system there will be a microprocessor and other necessary mechanism to transaction. When we will attach the two cards the transaction will be done.

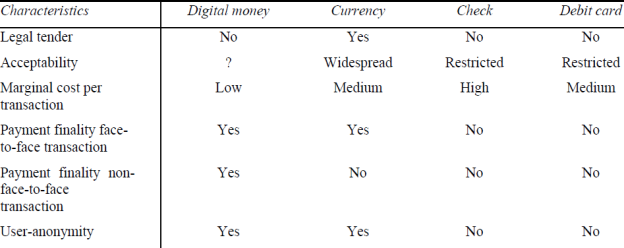

Showing a Table to visualize the characteristics of currency, digital money, checks and debit cards:

Fig. 2. Characteristics of currency, digital money, checks and debit cards [1]

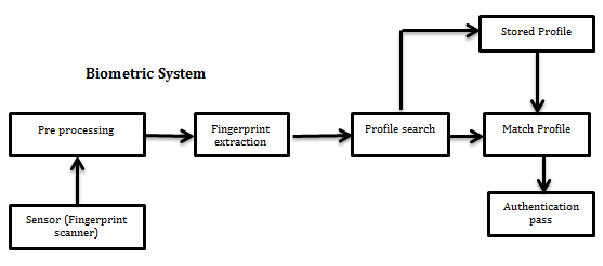

In this research, security is the main issue [3]. To handle exceptional cases, we need to have a strong security system. To avoid uncertainty, we will provide a finger print security system. Showing a figure to handle Biometric System:

Fig. 3. Biometric System for smart card

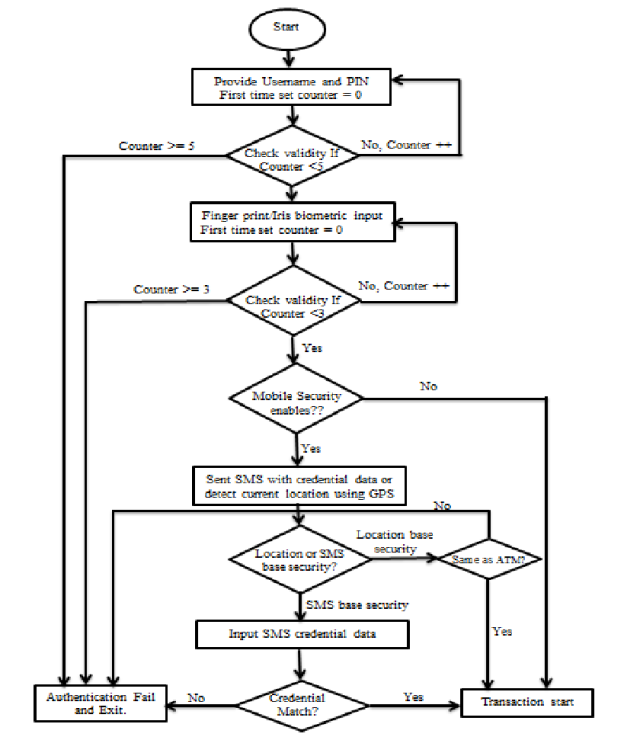

For demonstrate the overall working procedure, we are proposing an algorithm:

Fig. 4. Working procedure of e-money (smart card).

The usability of the system is the main advantages and security is the drawbacks. Since, we are using biometric system it will help us a lot to secure the whole system.

Conclusion:

There are no systems which are stable for forever. But by building a secured and feasible system, we can use years after years. The proposed technologies are not an alternative role of the present e-money rather than support them to make it conform to the all kinds of people. Moreover it is reducing the need of an extra machine to read.

References:

- Aleksander Berentsen, monetary policy implications of digital money, 1997.

- Report by the Committee on Payment and Settlement Systems and the Group of Computer Experts of the central banks of the Group of Ten countries, security of electronic money, August 1996.

- Staff from the U.S. Department of the Treasury offices, an introduction to electronic money issues, September 19-20, 1996, Washington, DC.

- Aleksander Berentsen, Digital money, liquidity, and monetary policy, http://firstmonday.org/ojs/index.php/fm/article/view/1512/1427#1, 5 December 2005.

- Humphrey, D., L. Pulley and J. Vesala, Cash Paper and Electronic Payments, November 1996.

- Mohammad salah uddin, Member, LACSIT, and Afroza Yesmin Akhi, E-Wallet System for Bangladesh an Electronic Payment system, 3 June 2014.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal